This article will give you a comprehensive understanding of how to trade with a forex currency strength meter and how to avoid common mistakes when using the currency strength meter. You will also learn how to effectively use the data received from this indicator.

The foreign exchange market differs from other financial markets in the concept of currency pairs. This involves buying or selling one currency at the price of another. Each pair has a structure that designates one as money and the other as a commodity product. All these transactions are possible due to changes in the relative strength of the different currencies, allowing traders to profit from price fluctuations.

All traders face the prospect of trading two different currencies, and this is where the exciting opportunities arise. With a currency strength meter, they can evaluate the relative strengths of each currency in order to make informed decisions that reduce their risk

Traders get a unique opportunity when they have two different currencies. They can measure the strength of one currency against the other, leading to potentially profitable results.

What is the purpose of the Currency Strength Meter?

As a trader, you need to know which currencies are getting stronger or weaker in order to take advantage of profitable trading opportunities. The Currency Strength Meter is a useful visual guide that you can find online or on certain trading platforms like MT4 and MT5.

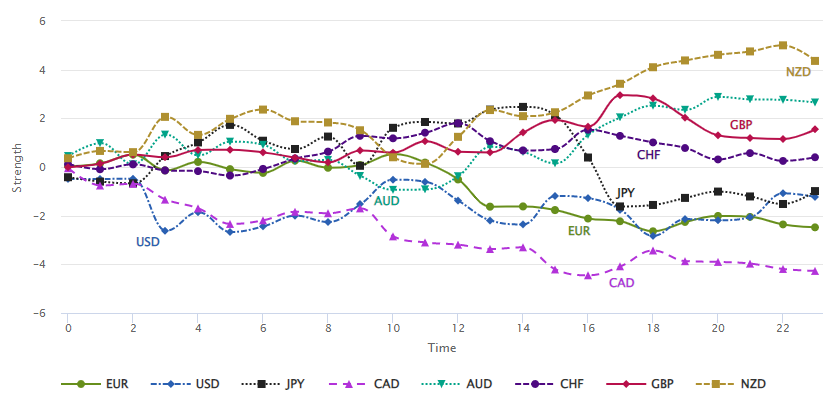

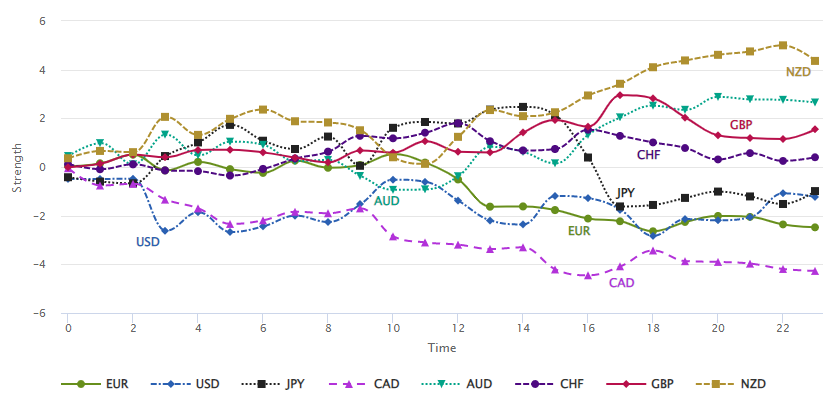

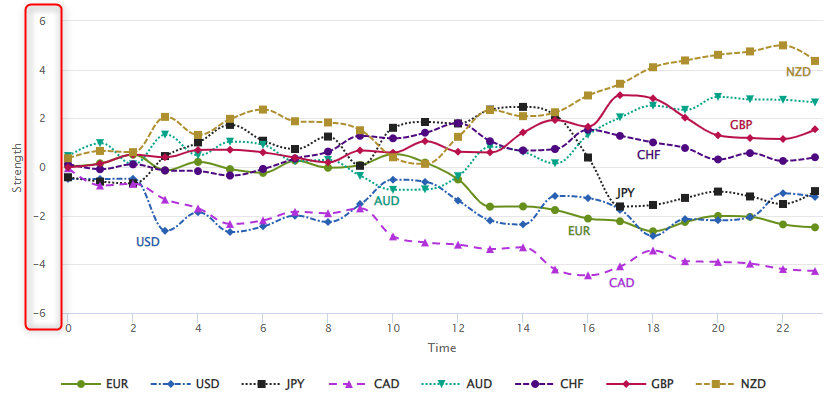

This tool creates accurate and composite data by using the exchange rates of various currency pairs that are available for buying and selling. Technical indicators provide insight into current market conditions and tell traders when to trade. With the help of the currency strength meter, traders can easily see which currencies are worth paying attention to.

A common market scenario is that there is a strong currency that could potentially continue to rise, and a weak currency that could fall even more. How can we make the most of this situation? If it is possible to pair the strong currency with the weak one, traders can add another trading strategy to their repertoire by taking advantage of this opportunity.

Let us say that the British pound is rising against all other major currencies, while the US dollar is declining against the others. In such a situation, a forex trader could think of buying the GBP/USD currency pair and profit from the rising base currency (British pound) and the falling quote currency (US dollar).

It is not necessary for a currency to rise or fall relative to all other currencies available on the market to be considered strong or weak. If it rises relative to the major currencies, it can be labeled strong, and if it falls relative to the major currencies, it can still be labeled weak. This gives traders the opportunity to pair these currencies for trading operations that have a high potential for success.

What is the process involved?

It is important to know that the time frame in which you trade makes a big difference. A single currency can be strong or weak depending on the time frame (from a minute to a month). Therefore, it is important to consider the time period when choosing currencies.

The Canadian dollar may seem quite strong for today's time period, but if you analyze it on a monthly basis, it could be one of the weakest currencies. Although the forex currency strength meter can be helpful in these short-term trades, it is often beneficial to expand your options and make longer transactions.

To avoid possible confusion, it is recommended to choose a time frame that suits your trading needs and fits your approach. Day traders who prefer short-term trades tend to use a 30-minute or 1-hour time frame, while those who prefer longer-term investing prefer the daily time frame. However, keep in mind that there is no definitive best or worst time frame for trading. It all depends on what strategies you use and how much time you have available (if you do not rely solely on trading).

It is not recommended to invest in two currencies that have high or low levels at the same time on different timeframes.

Most strength meters utilize their own method of measurement. Typically, a scale of 0 to 10 is used to indicate the strength of a particular currency, with higher numbers indicating greater strength and values below 0 indicating a weaker position.

For many new traders, the Currency Strength Meter (CSM) is the cornerstone of their trading strategy. However, it is important to remember that all aspects of a trade are interdependent and must be considered together. The CSM can provide valuable insights when combined with other indicators and analytics according to your particular strategy; this market is very volatile and conditions can change in the blink of an eye.

While the CSM should serve as the basis for your analysis, it does not take into account all the factors that are important for successful trading. Instead, it only helps you identify currencies that are worth analyzing. It is beneficial to take a broad view of the situation, as there are several elements that can significantly weaken the value of a currency in the shorter term. However, if you take into account longer-term periods, these factors will be more balanced.

Advanced meters are available that use a combination of economic performance and fundamentals to determine the strength of currencies. Hundreds of economic reports from different economies are examined using complex algorithms to determine potential growth or recession. In this way, traders receive information not only about past market conditions, but also about current and future trends that could affect global markets. This approach dramatically increases the chances of successful trading moves while saving time - there is no room for error.

The distinction between strong and weak currencies refers to the relative value of a given currency compared to other currencies. A strong currency has a higher purchasing power than a weaker one, which means that you can buy more goods and services with it in comparison. Conversely, a weak currency has lower purchasing power and is worth less than another currency.

It is extremely important to understand the strength and weakness of different currencies because how successful your trading activities are depends on it. Similar to other financial instruments, the trends of the different currencies are determined by the current market conditions.

Strong vs. Weak Currencies

Some countries are considered "safe havens" due to their economic and political stability, even when the global economy is unstable due to politics, environmental changes, public unrest, or a pandemic. As a result, the currencies of these countries remain strong in difficult times and can be expected to stay afloat.

The U.S. is seen as a country that can weather global uncertainty well, making it one of the most important "safe havens" for investors. This makes its currency very desirable and less risky to trade. However, weak currencies are just as valuable as strong ones and can be profitable if you do thorough market research and keep up to date with current trends.

Learning how to use a currency strength meter effectively will help you make better trading decisions.

Forex Strength Meter uses an algorithm to help traders determine the strength of a single currency. This financial tool can be used on MT4 and MT5 or other platforms that allow custom indicators. You can also find a Currency Strength Meter app online (like this one).

With this indicator, traders can determine which currency is performing well in a given period and which is not. They can then use this information to develop their trading strategies by incorporating it into their charts.

The Forex strength indicator does not provide traders with any assistance in navigating the fluctuating market.

Professional traders recommend using the FX strength meter as an additional verification. First of all, a trader should determine the pros and cons of the trade. Then, based on the collected data, he can decide whether the trade is worthwhile or not.

Common mistakes when using a currency strength meter

Novice traders may make mistakes when using the currency strength meter during trading.

Mistake #1 - Using a currency strength meter without understanding how it works.

A currency strength meter uses a calculation to determine whether a particular currency is strong or weak. However, if a trader does not understand how this formula works, it is difficult for him to trust the result. The currency strength meter works only on a daily basis. So, in order to use any tools or indicators, you need to know the underlying principles.

Mistake #2: Signal to enter a trade.

One of the most common mistakes inexperienced traders make is relying on a currency strength meter to decide when to open a trade without doing any further analysis. For example, they choose the strongest currency pair and buy it expecting the price to rise. This is not advisable.

A currency strength meter can help you figure out which currencies are strongest or weakest at the moment, but it does not give you a recommendation on when to enter a trade.

Mistake #3: Using CSM on fluctuating market.

Most current strength indicators measure the shift in value to determine which currencies are strong or weak, but this can lead to misleading information on a short-term basis.

In a fluctuating market, this can result from a sudden influx of information leading to a sudden change in price that does not accurately reflect the strength or weakness of the currency.